What Is a Will?

When it comes to estate planning, there are a lot of moving parts to the process. One of the first steps is having the appropriate documents in place. Sometimes, I’ll meet with a client who says, “Well, it’s just been a few years.” We take a look, and sure enough, it’s been around 15 years since they’ve updated their estate planning documents.

The reason so many people tend to put off creating or updating their estate planning documents is pretty apparent. No one wants to think about becoming incapacitated or passing away.

However, when you consider your family, friends, or whomever will need to step in if you’re no longer able or have passed away, having a plan in place helps make it easier on them. It prevents them from having undue stress. A will also helps relieve some of the burden of what can be an arduous process of closing your accounts.

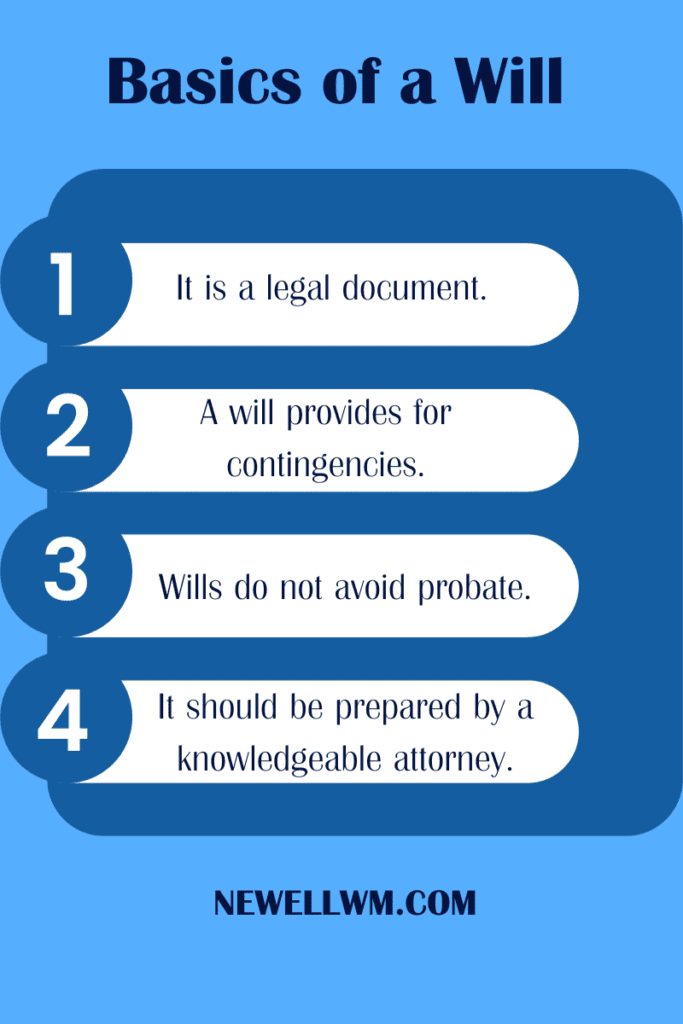

One of the primary documents in estate planning is a will. To help lay the groundwork for your estate planning, here are four things to know about this crucial document.

1) A will is a legal document.

A will outlines your wishes and intentions for the court regarding where you want your money and assets to go upon your passing. Whether you have a little or a lot, a will tells the courts what and how much goes to each person you’ve specified.

2) It provides for contingencies in the process.

What do I mean by contingencies? While we always hope that you and your spouse will pass away together holding hands at the ripe old age of 110, leaving your money and assets to the children, it’s not likely to play out that way.

Life brings many curveballs that throw a wrench into our best-laid plans. The human element of dealing with someone’s passing brings complexity to the mix. Things like divorce or multiple family members passing away at once can muddy the waters.

A will provides clarity around all of the potential complexities of life as far as where you want your assets to go. This doesn’t just mean the first level, but also second or third-level beneficiaries if the primary person is no longer living or cannot receive the inheritance for whatever reason.

3) A will does not avoid probate.

People often think that having a will avoids going through probate. Probate is the process where the court gets involved in the closing out of your estate to make sure that everything goes as it should.

The probate process allows creditors, debtors, long-lost family members, or anyone who thinks they have a right to some of your estate to make their claim. While it is a public process, the court uses the wishes of your will to determine the final outcome of asset distribution.

4) Work with a knowledgeable attorney.

Some attorneys are generalists, working in various areas of law. When it comes to will and estate planning, work with a knowledgeable attorney specializing in wills, trusts, and estate planning. It’s best to work with someone who handles these types of issues daily. They are the most qualified in understanding the process and navigating through probate.

Disney cast members can use the company’s legal plan benefit. It’s an excellent benefit for cast members at a minimal cost. The plan includes your will in an overall estate planning package with the proper documents.

If your company doesn’t offer a legal plan benefit, it’s still worth the investment, even if it’s a few thousand dollars. Having a solid estate planning strategy will save your estate much more than the cost of creating it.

Protect Your Estate

I’m sensitive to the fact that talking about passing away isn’t the most enjoyable conversation. Still, it’s essential to work through it to protect your family and the assets you’ve worked for.

Consult with your financial team to work through the intricacies of your situation. Together you can create a will and estate planning plan that makes it easier for those left behind.

If you would like guidance from an experienced financial planner, I’m happy to help.

We can meet virtually or in person if you live in the Central Florida area. Please email me at kyle.newell@newellwm.com, call/text at 407.337.7128, or schedule a meeting at Schedule – Newell Wealth Management (newellwm.com)

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.