What is a HSA?

Another acronym? Seriously? Yes, seriously… The financial world loves acronyms and jargon. Added to that mix is the HSA. So, what is HSA? What does HSA stand for? HSA is short for health savings account. That’s helpful, right? The name does give us some clues but I will expand upon that here so you understand more about HSAs, how they work, some advantages, some disadvantages and what you might use an HSA for.

What is a HSA?

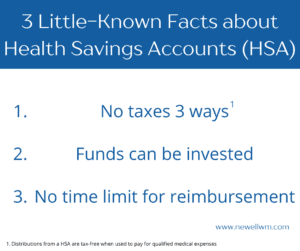

Health savings accounts are investment and/or saving accounts that can be used to pay for qualified medical expenses. An HSA can be contributed to on an ongoing basis or sometimes a lump sum contribution is allowed. Those contributions are made pre-tax. Pre-tax means when your contribution goes into your HSA from your paycheck, it is before taxes are taken out. For example, let’s say you are paid $2,000 in one pay period and you contribute $50 to your HSA, you are only taxed on $1,950 of income.

In addition to contributions being pre-tax, the funds are able to grow tax deferred. This means that if the savings grows, you do not have to pay taxes on that growth. As an example, let’s say you contribute $5,000 to an HSA and over a year or two, it grows to $6,000. The $1,000 that was made is not taxable to you while it sits in the account.

Furthermore, an HSA is used to pay for medical expenses typically. The nice thing here, is that when an HSA is used for qualified medical expenses, the distribution from the HSA is tax-free. Going back to our example where you made $1,000 gain on your initial contribution, if you took that out of your HSA to pay for a qualified medical expense then that gain is, get this, tax-free! That’s right, no money to Uncle Sam. Pretty cool, right?

If you ask me what is a health savings account or what is an hsa account? I would tell you it is an awesome way to save on taxes and the only thing I know of that allows you to save on taxes 3 ways! Going in, growing, and going out!

All that sounds good. I mentioned the expenses need to be qualified medical expenses. So, you might be asking “what can I use my HSA for?” Good question.

What can you use a HSA for?

A lot. The IRS is the group that keeps an eye and lists all these things, so keep that in mind. This also is not an exhaustive list. From a broad perspective, what can a HSA be used for? A qualified medical expense. Then the question is, what are qualified medical expenses for a HSA? Generally, these are things you might think of, doctor visits or procedures, prescribed medicine, tests, and things of that nature that are meant to diagnose, cure, treat, prevent etc.. the IRS states that something that would generally qualify for a medical expense deduction can be used as a qualified medical expense. I won’t repeat the entire list that can be found on the IRS website but will mention a few items one might not initially consider when thinking about what expenses qualify for a HSA:

- Insurance Premiums: Now, your typical health insurance premium that comes out of your paycheck will not qualify. However, there are a few instances that are covered as a qualified expense for an has. Such as:

- Long-term care insurance: This is insurance that one would put in place to cover risk of needing to pay for a nursing home for example. This is really interesting as I do not think many people would consider this is an expense for a HSA but it makes a lot of sense Congress would do this because nursing homes and other long-term care is REALLY expensive. I hope to write further about this soon.

- Continuing coverage health insurance (like COBRA): Have you seen the cost of COBRA? It is price-y! Thankfully you can use a hsa for COBRA coverage.

- Healthcare coverage while unemployed: I saw a lot of people use this during the COVID layoffs. This applies to a larger basket of insurance than just COBRA as someone might be on the ACA (aka Obamacare) exchanges health insurance and unemployed so could use their HSA to pay those premiums.

- Medicare: Once you are 65, you are eligible for Medicare, which is insurance subsidized by the government. There are several components, but any premiums associated with it are covered by your HSA.

- Updates or upgrades: If you need to update your house or car to accommodate some sort of medical necessity this to qualifies. I think about a family member I had that was disable from the waist down. He needed to have all of his cars fitted with hand controls so he could drive. Each time he did that, he could have used an HSA to pay for it.

- Reimbursement: As of now, there is no time limit on when you can file for reimbursement. Meaning, if you are able to pay for expenses out of pocket you can file to have those expenses reimbursed at a later date or even potentially years later. This might allow you to add many expenses close together to be reimbursed rather than in bits and pieces. This might also allow for your funds to potentially grow if invested.

Again, the IRS website is pretty helpful so you’ll definitely want to check there and/or with your tax adviser if you are unsure.

That all sounds great, what is the catch?

Like most things in life, there are some potential drawbacks to using a HSA. One of the biggest drawbacks to the hsa is the hsa insurance requirement of having a high deductible health plan. A high deductible health plan or high deductible insurance coverage is just as it says, insurance that comes with a high deductible.

The deductible is the amount of money you pay before the insurance kicks in. With a high deductible health plan this is a lot higher than a more traditional plan with the minimum deductible for a single person at $1,400 and for a family at $2,800. Meaning, if you go to the hospital and you had nothing else wrong that year, you will pay the full $1,400 before insurance picks up any of the tab.

As such, the high deductible plan almost necessitates someone choosing that insurance to have some money in their pocket. To provide incentive to save for that the HSA was invented. However, the cost still exists and for many that is a hurdle to choosing a HSA eligible health insurance plan.

Another drawback is HSA plans might have a limited number of investment options or no investment options at all. If one is planning on saving the HSA funds for future use, they may want to evaluate if it is better saved in an HSA or some other sort of retirement plan or investment account.

One more downside of the HSA is the obvious one, it really should only be used for medical expenses. So if you are in a bind or want to access the cash for something other than a qualified medical expense, there are potential penalties and taxes associated with it.

Anything else I should be thinking of?

A final question I always ask if someone does have a HSA, is to consider when is the best time to use the money in that account? As the HSA funds do roll-over from year to year and have the potential to keep growing if you do not use them.

Understanding the details of the HSA and how it applies to your overall financial situation is key. In addition, you’ll want to review your specific plan documents to understand what may or may not be available.

Ultimately, when considering a HSA both one’s health and finances are part of the conversation.

Sources:

Duke, A. C., and Cude, B.J. (2016). Motivating Personal Contributions to Health Savings Accounts. The Journal of Consumer Affairs, Fall, 652-665.

IRS.gov. Health Savings Accounts. https://www.irs.gov/publications/p969#en_US_2021_publink1000204083

IRS.gov. Medical and Dental Expenses. https://www.irs.gov/publications/p502#en_US_2021_publink1000179043

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.