How to Understand the Disney 401k Benefit

Summary

Overview of the Disney 401k from a financial advisor in Winter Garden, FL.

Many Cast Members have questions about how to understand the Disney 401k benefit also known as the Disney Savings and Investment Plan (SIP). Before we get into specifics, it’s important to offer some basic understanding of what a 401k is and how it works. Let’s start with a little history.

What is a 401k?

A 401k is a part of the IRS tax code. The IRS has all these rules and regulations around taxes. So, to organize those rules, they assign different items and sections. 401k is Section 401 Item K of the IRS tax code rulebook, hence the name 401k. This regulation outlines how a 401k is treated from a tax perspective. The 401 K allows you, as an employee, to contribute to your retirement in a tax-advantaged way. It also provides the added benefit of allowing the company you work for to contribute on your behalf.

It’s made for your retirement because the government wants people to be able to retire and cover their expenses in retirement. The 401k was initially invented to be a supplement to pension plans. From the 1900s until around the 1990s, pension plans were the main benefit for employees.

As people became healthier and lived longer, it became problematic financially for companies to have pensions. As the pension became a burden, many companies transitioned to the 401k plan. Most have a 401k match as well. Disney does have a pension which we will discuss at another time.

When are you eligible?

At Disney, you’re eligible for the 401k (aka Disney SIP) automatically after 90 days of employment. You don’t have to go in and enroll; it will automatically happen as far as your eligibility goes. After eligibility, you can go to your designated benefits center on the Hub for Benefits. You can log in to the Fidelity benefits page and enroll your desired contribution amount.

How do contributions work?

You can contribute up to 50% of your salary or whatever the annual limit is for the IRS for the 401k contribution for that year. The annual limit for a Disney 401k contribution in 2025 is $23,500 for ages 50 and under. If you’re over 50, you can add $7,500, giving you a limit of $31,000.

There was also a recent law change where those age 60-63 may be able to contribute an additional $11,250 to their Disney 401k (SIP).

You may or may not be able to contribute that much, but that’s how much you are allowed to contribute as long as it’s less than 50% of your total salary. Fidelity will keep track of it for you. If you contribute more than that, they will stop your contributions whenever you start to reach that limit.

You may or may not want to do that because you want to get the company match. Let’s shift and talk about company matches.

Company matches

For salaried cast members. the company will provide a match for your contributions, up to 4%. They will match you up to 4% – 50% of your contribution. For example, you contribute $1. They will match you $.50 on that dollar, up to 4% of your salary. For hourly cast members, the match is somewhat different, and sometimes it depends on if one participates in a union or not.

If you make $100,000 per year and contribute 4% of your salary, your contribution is $4,000. With the company match, they would put in $2,000. If you contribute $10,000, the company will still only give you $2,000 because they will match up to the 4% amount.

If you want to be on track for retirement and wish to contribute more, you can, but the company will no longer contribute once you go above the 4%.

Traditional vs. Roth Contributions

You have the option with a 401k to do what is known as traditional contributions or Roth contributions.

1) Traditional contributions

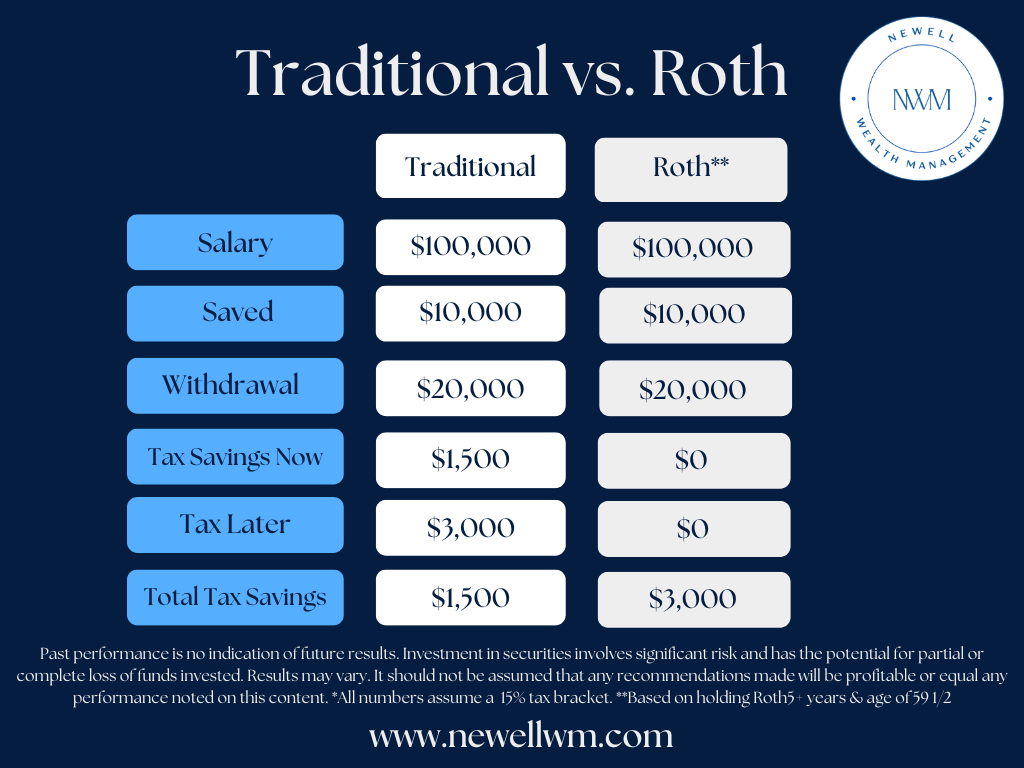

A traditional contribution allows you to contribute before paying any federal income taxes. So, for example, let’s say you make $100,000 a year and contribute $10,000 to your 401k for the year. You will only be taxed on $90,000 of income rather than $100,000. It’s a tax benefit for the year.

Please talk with your tax advisor about your specific tax rate based on your income bracket but for this example, let’s say you make $100,000 and have an income tax rate bracket of 15%. If you contribute $10,000 via traditional contributions, you will have a $1,500 tax savings this year.

2) Roth contributions

The Roth contribution was named after Senator William Roth, the congressman who created the idea in 1998. To give you an example of how the Roth works, let’s go back to the previous model. If you make $100,000 a year and contribute $10,000 to your 401k via Roth contributions, you will still be taxed on $100,000 of income for the year. So why consider this?

With the $10,000 now in your Roth 401k and invested, hopefully, it earns money over the lifetime. Maybe it’s 5, 10, or 20 years; for example’s sake, when it’s time to retire, the $10,000 is now $20,000.

With the traditional account, if you took the $20,000 out, it will all be taxable income the year you take it. That’s how a traditional account works. You don’t pay taxes when it goes in, so you are taxed on all the money you take out. If you are still in the 15% income tax bracket, you will pay roughly $3,000 in taxes on the $20,000 you took for that year.

Conversely, if you do the Roth account and all numbers remain the same, you can take the $20,000 out tax-free. To take advantage of this, there is a provision that you must have held the account for five years and be over 59 ½. Using this concept means you only have $1,500 in taxes (from the original $10,000 invested) to have $20,000 down the road.

To compare, you paid $3,000 on the traditional contribution for the same $20,000 down the road. The question now becomes: should you make a Roth or Traditional contribution? Some people will say they want both.

Your decision depends on several things.

- What are your taxes now?

- What’s your income now?

- Would it be higher or lower later?

- Do you think the tax code would be the same or different later?

Many assumptions must be taken into consideration. It’s something to talk to your financial planner about. Run some scenarios to find the best options. CPAs and tax advisors often lean more towards taking the tax savings now versus later because you don’t know what may happen in the future.

From a financial planning standpoint, sometimes I go the other way. I look at going ahead and paying the taxes now because you know you can afford them now. That gives you the option of not having to pay them later. Again, you want to decide based on what your income taxes are now versus what your income may be later, especially if you’re a leader.

As a leader, you may have LTI, RSUs, or maybe some complicated and higher income. If your spouse is a high earner as well, having the tax savings now could be a good idea. Running some analysis with your financial planner can help you be thorough in your decisions.

Investment Options

There are several different types of investment options within the Disney 401k. Once you decide to contribute, how much you want to contribute, and whether to do it as a traditional or Roth, you may wonder what’s next. Where do I put the money? Disney offers a few options, which I will cover in greater detail in a future article. From a high level, you have three initial choices to make on your 401k investment allocations.

1) Managed Program

This is where you’re paying fidelity an advisory fee to manage your portfolio. They will do rebalancing and choose the investments on your behalf. The cost of this program is based on asset value and is currently as follows.

Under $10,000 = .07%

$10,000 – $100,000 = 0.42%

$100,000 – $250,00 = 0.32%

$250,000 and up = 0.27%

Under the managed plan, Fidelity will monitor your investments and make changes on your behalf, usually every quarter. What is nice about it is that you do have some semblance of professional advice. This advice is not based on your overall financial picture. It’s given without personal consideration and only on whatever assets are within the 401k.

Typically they ask just a few questions about your risk tolerance and some basic information. The computer then spits out some recommendations. Fidelity then monitors it from there.

There are a few drawbacks to a managed plan like this:

- The cost involved

- Lack of personalization for investment recommendations

- Not considering the overall financial picture

2) Target date funds

Mutual fund companies run these. The Fidelity plan uses BlackRock, a large institutional manager. BlackRock is one of the most prominent asset managers in the world. It is similar to the advisory program. Target date means, whatever the date is, they assume you are retiring at that time. 2025, for example.

They position the portfolio in a way that someone who is planning to retire in 2025 would want it handled. There are many assumptions with this type of management, which is done from a corporate level.

It’s better than nothing, but those recommendations have no specification or personalization. It’s whatever the company thinks a person retiring at that target date should have their portfolio positioned. They will make changes as you get closer to or past that date.

Someone younger may have a 2040, 2045, or 2050 fund. Those are going to be more aggressive than someone with a 2025 fund. Some pros for this are again that you do have some professional help, and they are choosing the investments for you. You may feel uncomfortable selecting investments. This allows you to delegate those decisions to this mutual fund company.

These come at a bit more cost than your other funds, but they are a decent option.

Drawbacks are:

- Lack of personalization

- The chosen allocations may or may not align with your financial situation

- Allocations may not align with your overall strategy

Often these funds, for specific reasons, have large allocations to international investments. International investments have not been great for the past ten years or so, which means the lack of personalization can potentially cause fewer returns.

3) Choose the investments yourself

This last option is where you decide for yourself where to invest. There are many different types of investments you can select.

- Stocks and bonds

- Cash accounts

- Actively or passively managed funds

You can select funds specific to you based on your financial situation based on your overall net worth, your spouse’s income, and your assets.

Withdrawal Options

When you leave the company, you have several options.

- Take your 401k to your new employer, leave it where it is or move it into an IRA – generally, these options are tax-free in nature since they will be going to a like account tax-wise.

- Cash out your 401k, which may come with penalties if under 59.5, and may be charged income taxes.

- Another option is to convert your 401k to a Roth IRA, which again, may have tax consequences associated with it.

There are some special considerations as well if you own Disney stock within your company 401k as well, so it will be prudent to understand your options of keeping the stock as it is, cashing it out, and how taxes might apply.

If you’re still working, you have loan options where you can borrow against the money in there.

Borrowing against a 401k is an option, but it’s usually one of the least desirable options and used as a last resort.

Yes, if you take a loan against the money, you’re paying yourself back. At the same, you’re being taxed twice on that money.

You can borrow from your traditional 401k, up to 50% of the value, or a maximum of $50,000.

Example:

If you have $100,000, you can borrow up to $50,000

If you have $1,000,000, you can still only borrow $50,000

If you have $50,000 in your 401k, you can only borrow $25,000

The payback period is up to five years. The payment back into the account is now an after-tax payment, whereas the original contribution was a pre-tax amount. In its simplest form, you are paying taxes to put the money back in and will pay again when you take it out in the future. This amounts to paying taxes twice on the same money.

When leaving the company, Fidelity will give you a call to ask you to work with them. You can leave the money and have them manage it or move it out of the 401k. It’s not required but is an option.

Special rules with a 401k

There are a few special rules, especially regarding Disney stock. You can own Disney within the 401k. Whatever you buy the Disney stock at, hopefully, it appreciates. When you retire or leave the company, be sure to check if you do have Disney stock. You will want to evaluate your special tax rules associated with that. There are some potential benefits, such as having the Disney stock use capital gains versus ordinary income taxes.

Beneficiaries

You can assign beneficiaries to your account. Usually, if you’re married, you will want to assign your spouse as the primary beneficiary. If you’re not married, you can name anybody you want as the beneficiary.

If you have young children, there are some considerations with them as beneficiaries. You may want to consult an estate planning attorney. If you die while they are under 18, the money will have to go to probate. A guardian would need to be appointed even if you have a will. The court will need to be involved with the money for your children until they turn 18 and can take the money themselves.

Taxation upon death is something that people don’t think about because nobody wants to think about dying. Your 401k, if it’s a traditional account, will be taxable to your beneficiaries. The IRS recently passed new rules around the payout of a 401k to beneficiaries.

There used to be a required minimum distribution on the inheritance. The beneficiary could take it a little at a time forever. The new rule is that it must be taken within ten years if you pass away after 2020.

An inherited Roth will still be a 10-year window for taking the money out, and there’s a minimum distribution due each year on that. This money, however, is tax-free. Since you paid taxes on it already, the money is tax-free for you and your beneficiaries.

If you leave the money to your spouse, they can turn those accounts into their own retirement account. They will then follow the tax rules with their account for withdrawals and minimum distributions. If your children or someone other than a spouse inherits the money, they would have to take the money out with a minimum distribution schedule over ten years and have to drain the account by those ten years.

Don’t be overwhelmed.

When looking at the Disney 401k program and Disney cast member retirement benefits in general, there are many things to consider. It can be easy to feel overwhelmed. If you would like to talk about your specific situation and the options that may be best for you, I’m happy to help.

How I came to Disney

I have come to have a good bit of experience with the Disney 401k as I worked there for several years, predominantly serving Disney leaders, Cast Members, Imagineers, Crew Members, and other employees of the Walt Disney Company. Working at the Walt Disney Company is a dream come true for many. It was something I always wanted to do as a kid growing up. From Tampa, FL, we would travel to Disney on a fairly regular basis to go to the parks. There were times when we couldn’t afford to go to the park, so we would go to what was then called Downtown Disney (now called Disney Springs) to enjoy the property and get some of that Disney magic. There was a seed planted when I was a kid that made me want to work for Disney.

My childhood dream was to work within Imagineering. I was always enamored by the idea of being able to design the roller coasters, the worlds, and the theming. I graduated from school in December 2008, and the economy wasn’t the best for securing work. Disney wasn’t hiring much at that time due to the economic situation. While waiting for my dream job at Disney, I went into financial services. Initially, I took that route because it was just about the only job I could find. I enjoyed it and decided to pursue that as my career instead.

My wife and I were living in Gainesville, Florida, where we met, and I went to school. I worked as a financial advisor for about ten years in that area. I began to get the itch to make a change and was considering starting my own firm when the Disney dream reappeared but in a different format.

I imagined working with Disney cast members as a specialty or niche focus. As I began researching the possibility, I ran across a job posting for the exact path I was considering. The job was listed for Partners at Disney. I had no idea what Partners was or who they were, but I saw Disney and was immediately interested.

With more research, I determined that Partners is within the credit union framework for Disney cast members. Working for them would allow me to accomplish both of my goals, working for Disney and specializing in financial advising for Disney cast members.

I don’t believe in coincidences. I think it was God giving me an answer to a prayer from many years ago. I talked to my wife about it to see if she would be open to moving from Gainesville toward the Orlando area, and she said, “You’ve always wanted to work for Disney. Give it a try!”

I applied, went through the interview process, and, sure enough, got the job!

In my new role with Disney, I spent a lot of time learning the specifics of the Disney 401k program and benefits. For about four years, I had the pleasure of working with Disney leaders and cast members of all ranks and files of The Walt Disney Company, helping them plan for retirement, and make sound investment decisions and intelligent money decisions.

When it comes to the Disney 401k, there are a lot of different moving pieces. You should have a good overview of how it works, the pros and cons, and what you should look out for. Having participated in the Disney 401k plan, working with hundreds, if not 1000s of cast members on their 401k, and being a Certified Financial Planner Practitioner means I am well-equipped to provide the information and guidance you may be looking for.

Furthermore, I put together this guide reviewing some of the most common mistakes I see with the Disney 401k. I hope you find it valuable.

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

Newell Wealth Management, LLC and it’s employees are not affiliated nor endorsed by the Walt Disney Company or its affiliates.