How to Understand & Evaluate Stocks

In the investment world, stocks are prevalent. Generally, if one is building a portfolio, one really can only go about it with some sort of allocation to stocks. Stocks can be confusing for people because there are a lot of different components and moving parts to them.

When my boys were younger, we started saving for them. I wanted to encourage them to understand the process and begin to learn about investing. One day, I was explaining to them that one of the components of stocks is that you get to own part of the company.

They got very excited and, of course, they wanted to buy stock in big-name companies that they knew. They started talking about how they would now own these companies. I had to pump the brakes on their enthusiasm and explain that they wouldn’t own the company, just a tiny part of it.

It can be great to be a part owner with stocks, but there comes a lot of complexity when thinking about stocks. To help you understand and be more comfortable with stocks, I’d like to discuss a few things I consider when investing in stocks.

Ownership

My boys understand that owning stocks means part ownership of a company. A company issues shares of stock to shareholders. Those shareholders then partially own that company.

There’s only a certain number of shares that a company will issue. I had to teach my children that how much of the company you own depends on how many shares you have.

As part owner of that company, you get to enjoy the rewards of the company. If the company does well by increasing sales, revenues, and profits, hopefully, the value of your stock will go up. Ownership of the company gives you the right to future cash flows of that business. As a stock owner, the income that a business produces, you get to participate in that revenue.

However, at the same time, companies are not always successful. Ownership means you participate in the downside of business as well.

The ownership aspect is essential to understand. Owning stock in a company is a different mindset than putting money on deposit at the bank or even investing in bonds or other types of investments. Because stocks give you part ownership in a company, you’re going to have the ups and downs of that company.

Potential Returns

People invest because they want to gain some sort of return, and that’s good. Historically, stocks have provided strong returns. We’ve been looking at strong average returns for the past 100 years. These returns come in two ways.

Capital Appreciation

Capital appreciation is the value of the stock increasing over time. The value increases because a company has stronger earnings. They are making more money and growing their earnings over time, which helps the company’s value. Many things help increase the value of the company. As a company’s value rises, you have the capital growth of your stock over time.

Dividends

The second component of potential returns is dividends. Dividends are a return to the shareholders of profits.

Every company may issue a different dividend. Some don’t issue dividends at all. Other companies will offer only dividends as a form of return. They may not be strong growing companies, have hit a plateau of growth, or have reached a certain market cap.

When it comes to stock investing, you’ll have both the capital growth and dividend potential. Companies that offer those different types of returns will then provide different risk appetites, which brings me to the third consideration.

Potential Risks

When looking at stock investments, consider the potential risks. The primary risk most people experience is stock value depreciation.

You may remember times like the early 2000s during the tech bubble or the “Great Financial Crisis” in 2008 and 2009. During COVID, some stocks dropped between 20% and 50% of their value.

To put a number on it, if you have $1 Million invested in stock, a 30% drop is a $300,000 loss.

Many people understand the risks when it comes to stocks. They love the potential return but understand the risk of potentially dropping value.

With an individual stock, you also have company-specific risks. The “Great Financial Crisis” was a systemic risk across the entire market. Almost every company dropped in value. However, there’s individual company risk with an individual stock, which can be good or bad.

It could be that one company can perform really well. Historically, most stellar performance comes from just a handful of companies that do very well while everybody else trudges along.

That said, the inverse can be true as well. This produces the primary risk of owning individual stock. The company could go bankrupt, and you could lose all of your money in that company. That has happened to some very big-name companies over the years.

Remember to do your due diligence on the risk potential before investing and understand the potential outcomes.

Evaluating Stocks

How do we go about evaluating which stocks to invest in? This could be, and is, an ongoing discussion as there are many different metrics. The two primary schools of thought are called fundamental analysis and technical analysis.

Fundamental Analysis

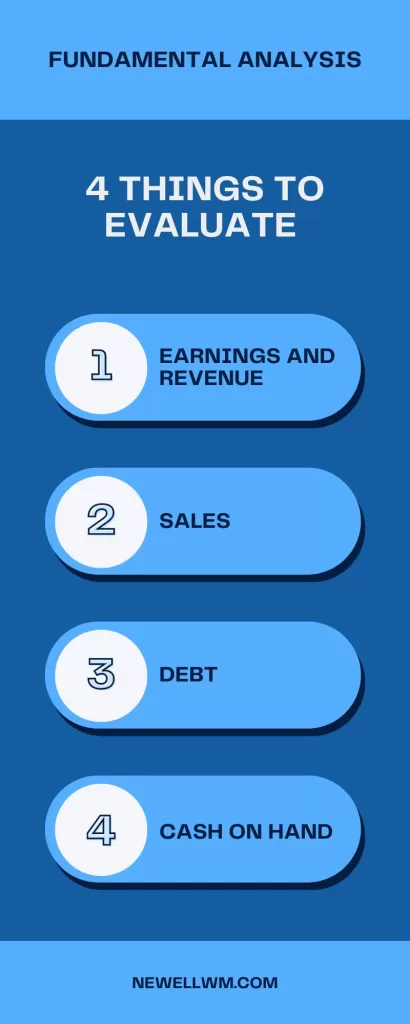

Fundamental analysis is where you’re looking at the company itself. You look at the overall economy and decide to invest in something that you believe will do well over time because they have things like:

- Good people working there

- Good processes in place

- Excellent technology or products

Ultimately, there are things that you believe give that company a competitive advantage at a fair price relative to the market. Be sure to also evaluate specifics like the ones listed here:

All of the analysis leads you to the belief that this is a solid investment within the overall economic scheme of things.

Technical Analysis

This type of analysis is concerned less with how the company operates, its revenues, cash, profits, etc. A technical analyst looks at the charts within the markets and decides, based on where the market is, if a company is undervalued or overvalued.

They typically use things like a 50-day moving average or a 200-day moving average. They see the value of the company over time. Generally, over time, “prices return to the average” is an assumption within that technical analysis.

If it’s above the average, it’s probably time to sell. If it’s below the average, it’s possibly time to buy. Technical analysts work by looking at different charts and many types of patterns. It gets complicated quickly.

The primary takeaway is that a technical analysis is not necessarily looking at the specific company but more at the broad market and patterns to help identify what companies are out of step. The result gives the analyst an idea of which sort of action to take.

Difficulties in Evaluating

There is difficulty in evaluating individual stocks. It seems almost simple to think, “Oh, well, this is a good company. I’ll invest in this and just hold on to it forever,” or, “Well, this is just a short-term thing.”

The past has shown that beating the overall stock market is challenging and almost impossible. The S&P 500, for example, is 500 large US-based companies. There are a lot of other different indexes. Investing in individual stocks and doing better than just the overall market has proven to be very challenging.

Much of this has to do with individual company risk and the fact that we, as humans, don’t have the ability to see all of the different variables and factors at play. When you have millions of people investing, the market can move very quickly.

With that said, there are things you can do based on your

- Preferences

- Investment style

- Tax ramifications

- Risk aversion

All of these factor into what sort of investment strategy you should choose.

Timeframes

One of the key fundamentals of investing is understanding when you will need the money. That gives you the ability to wait on your investment and let the investment work over a period of time.

Stocks, for example, over any given one-year period, could be up 40% or down 40%, or worse. However, if you can wait five years, the likelihood of them being down is very small; there may be less than a five or 10% chance that your stock investment will be down over a five-year period.

If you extend that even further to a ten or 20-year period, the chance of a stock being down decreases even more. That’s more the market than individual stocks. Every individual stock can vary widely, mainly because of the individual company risk.

Informed Investing

Stocks don’t have to be confusing. You can make solid investment decisions when you know the basics of how stocks work, the risks, and how to evaluate them. Indeed, there can be more to it, depending on your situation.

If you would like guidance from an experienced financial planner, I’m happy to help.

We can meet virtually or in person if you live in the Central Florida area. Please email me at kyle.newell@newellwm.com, call/text at 407.337.7128, or schedule a meeting at Schedule – Newell Wealth Management (newellwm.com)

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.