How Much is Social Security?

Joe and I were talking about his retirement plans the other day. He was curious about Social Security. He wanted to understand the ins, and outs of Social Security. He also wanted to understand how it pertained to his specific situation. As well as how much can you earn while on Social Security. He has done pretty well for himself financially over the years. He made sacrifices, saved, and invested. Now that he is getting close to retirement he found himself with more questions than answers. Not surprisingly, he did not have a great grasp on Social Security. I didn’t blame him; many people are not sure about Social Security.

Like Joe, Social Security income is a major part of most everyone’s retirement plan. Knowing how much can you make on Social Security, is an integral part of planning your retirement. There are a lot of factors that go into determining how much is Social Security. Your income, how many years you work, whether you are married or not and when you claim social security are all factors to be considered. I’ll go over each of these.

How to find the quick answer on “how much can I earn while on Social Security”:

The easiest way to find out how much do you get from social security is by visiting the Social Security Administration website, ssa.gov and registering there. Once logged in and verified, the Social Security Administration will provide you with a current estimate of your Social Security benefit. Each person is unique, so the amount varies by person and situation, so this really is the best way to get a solid answer.

Maximum Social Security benefit:

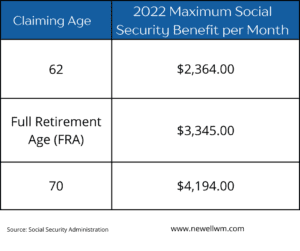

The maximum Social Security benefit varies based on when you decide to claim Social Security income. Now, these numbers do adjust over time, so these are the numbers for Social Security income benefits in 2022.

Age 62:

For example, let’s say you are looking at retiring early, you are done with the corporate red tape and bureaucracy, so you decide you want to retire as early as possible. You have saved well but the added guaranteed income from Social Security will help a long way towards stopping work earlier than planned. In this case, the maximum Social Security benefit for age 62 is $2,364.00 in 2022.

Full Retirement Age:

Now, perhaps you do want to retire early but have saved well and like the idea of waiting to a later date to claim Social Security benefits. There are a lot of reasons to do this, but for you, you like the idea of the guaranteed increase in Social Security benefits. At the same time though, you want to wait, but your mom and dad and your grandparents all lived to about mid-to-late 80s. So, you don’t want to wait too long and decide that full retirement age is the ideal time to claim your Social Security benefits. The maximum Social Security income benefit for full retirement age (FRA) is $3,345.00 in 2022

Age 70:

Or maybe, you enjoy your work and you’re okay waiting until the latest possible age to claim Social Security at age 70. You have longevity in your family history and you’re pretty health yourself. Furthermore, your spouse did not work as much or at all and would be dependent on your Social Security spousal benefit. With all of this considered, you decide to wait and claim Social Security at age 70. The maximum Social Security Income benefit for age 70 is $4,194.

As you can see, the maximum Social Security Income benefit varies based on when you claim Social Security benefits.

How your income affects Social Security:

How much money you make over your working years has an impact on how much can you earn on Social Security. When calculating your Social Security benefits, the Social Security administration looks at the best earning years over your working history. So, depending on how many years you worked and what your income was has a major impact on Social Security benefits.

One thing to be aware of is there is a limit on income counting towards Social Security. So, you might have been a very high income earner but for Social Security purposes, there is a cap on how much income they count (and how much they tax). The Social Security tax limit for 2022 is $147,000.

No matter how much income you earn though, Social Security generally taxes earned income so you have paid into the system at least to some degree. As long as you have had the minimum number of working years (they don’t have to be consecutive) you will be able to claim some sort of Social Security benefits. Another scenario if you did not work is if you were married for at least 10 years or are currently married, you are able to claim a spousal Social Security benefit.

The number of years you work affects how much you can earn while on Social Security:

Social Security looks at your best earning years to determine your Social Security benefits and how much you can make while on Social Security. It does this by looking at the best 35 years of income history to come up with your Social Security benefit. So, your benefit will be impacted a lot by how much you made over your entire career, and those with more consistent income might have the ability to have a better benefit than those who perhaps have a fewer number of years with higher incomes.

Another factor in considering the number of years you worked when it comes to Social Security is the minimum number of years worked. To qualify for Social Security benefits one must have the minimum number of credits (40) which ends up being 10 years (counted in quarterly estimates approximately). So, one has to have had worked at least 10 years but not consecutively to claim some sort of Social Security benefit. A common exception to this is if you were married at least 10 years or are still currently married, you have the ability to claim spousal Social Security benefit.

There are a lot of factors when considering when to claim Social Security and how much you can make on Social Security.

A good start is the Social Security Administration itself. Like most things government though, it can be hard to find the answers you need to your specific questions. This is where I am able to help.

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.