Social Security Full Retirement Age

“I plan to retire at 65, full retirement age.” she said confidently after I asked her about her plans for retirement. She went on “that’s when Social Security says I can retire so that’s when I want to retire.” I listened intently, trying not to interrupt her train of thought and finally she paused, so I asked “Were you aware the full retirement age for Social Security has been changed?” With a less confident look on her face, she admitted “no, I was not aware.” I told her “that’s okay, most people don’t realize the ages have changed.”

Social Security is a significant part of retirement income for many Americans. For some, it makes up the majority of their income. For others, it is the “icing on the cake.” No matter your situation though, understanding Social Security is a pivotal aspect to retirement planning.

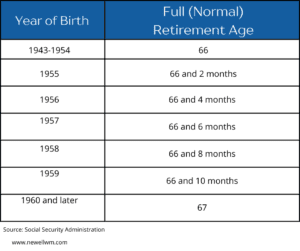

Plans are tough to form if we are not sure when they should start. So, when is full retirement age for Social Security? It depends on your year of birth. Here is a chart outlining when Social Security full retirement age is based on your year of birth:

As you can see, Social Security full retirement age was at one time age 65. Now, however, it is later depending on when you were born.

Who pulled the fast one?

Interestingly, these changes happened many years ago according to the Social Security Administration in 1983. For some reason though, people today still think their full retirement age is 65.

Why the change?

Well, Social Security over the years has morphed and changed. Adding in disability coverage as an example. Not to mention, population growth and overall health of the average American.

In fact, when Social Security was first enacted in 1934, the average life expectancy for a man was 59.3 years and for a woman was 63.3 years! So, you could claim your full benefit at 65, but most did not make it that long. Compared to today, where life expectancy is around 76 years old.

Therefore, since your average American is living well into their 70s (thank God!), people are receiving benefits longer and longer. To combat this, Congress made changes to increase the full retirement age in 1983. Bummer.. I know…

Will more changes happen?

A lot of questions come around will something happen to Social Security? This is really tough to answer. We do know that the Social Security trust fund is projecting it can pay full benefits until 2033. Let that sink in.. The Social Security funds are dependent on Congress possibly taking action like they did in 1983. Since it is further off, my gut tells me it won’t be addressed until we are closer to 2033. The reality is that no one really knows for sure how it might be addressed or if it will be addressed.

So, there you have it. With all of that said, hopefully you understand when your full retirement age is for Social Security.

Of course, you can retire whenever you want. The key is having a good plan to be prepared for both known and unknown factors that might impact you.

Sources:

Full Retirement Age, Social Security Administration. https://www.ssa.gov/benefits/retirement/planner/agereduction.html

History of Social Security, Social Security Administration: https://www.ssa.gov/history/briefhistory3.html#:~:text=The%20Social%20Security%20Act%20was,a%20continuing%20income%20after%20retirement.

Historical Life Expectancy, Berkeley. https://u.demog.berkeley.edu/~andrew/1918/figure2.html

Retirement Age Change, Social Security Administration. https://www.ssa.gov/benefits/retirement/planner/ageincrease.html#:~:text=Full%20retirement%20age%2C%20also%20called,born%20in%201938%20or%20later.

CNN (McPhillips), April 8, 2022. US Life Expectancy: https://www.cnn.com/2022/04/07/health/us-life-expectancy-drops-again-2021/index.html

Actuarial Status of the Social Security Trust Funds, Social Security Administration: https://www.ssa.gov/policy/trust-funds-summary.html

Important Information

Newell Wealth Management, LLC (“NWM”) is a registered investment advisor offering advisory services in the State of FL and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by NWM in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only and is not intended to provide specific advice or recommendations for any individual. Opinions expressed herein are solely those of NWM, unless otherwise specifically cited. Kyle Newell and NWM are neither an attorney nor an accountant, and no portion of this website content should be interpreted as legal, accounting or tax advice. Material presented is believed to be from reliable sources and no representations are made by our firm as to other parties’ informational accuracy or completeness. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investment involves risks including possible loss of principal and unless otherwise stated, are not guaranteed. Any economic forecasts set forth may not develop as predicted and are subject to change. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.